ABOUT CUSTOMER LIFETIME VALUE

CLV Models

The extant CLV literature has covered a wide range of business settings through the measurement approaches. This coverage has expanded the scope and application of CLV-based models across industries and markets (Kumar, V., and Werner Reinartz (2016)). Some of the popular approaches are discussed here.

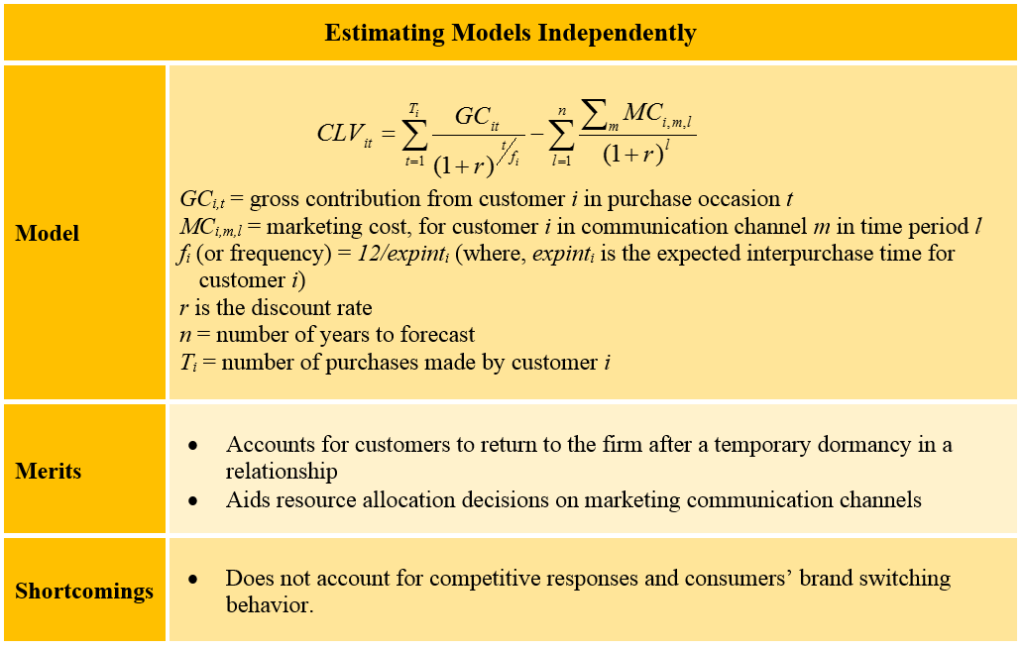

Estimating models independently (Venkatesan, and Kumar (2004)): Most models, barring few (Niraj et al. (2001); Venkatesan, Rajkumar, V. Kumar, and Timothy Bohling (2007)), focus on predicting the future revenue and apply a constant gross margin and retention cost. Venkatesan and Kumar (2004) use a generalized gamma distribution to model inter-purchase time, and employ panel-data regression methodologies to model the contribution margin. They consider various supplier-specific factors (channel communication) and customer characteristics (involvement, switching costs, and previous behavior) as the antecedents of purchase frequency and contribution margin.

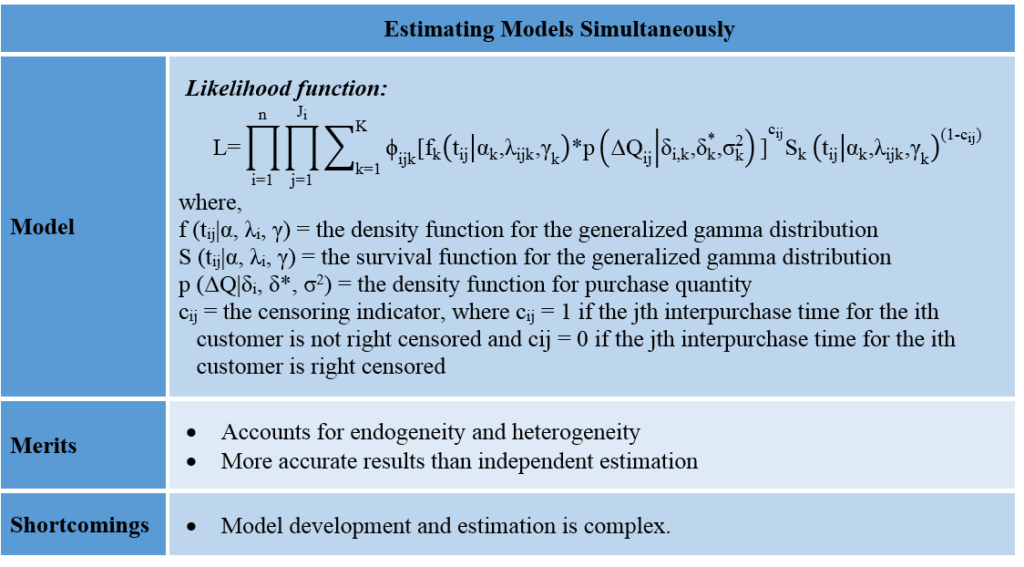

Estimating models simultaneously (Venkatesan, Kumar, and Bohling (2007)): Endogeneity is a statistical issue in the CLV model that relates directly to causation. When predicting purchase frequency, marketing cost, and gross contribution independently, it becomes unclear if it is current marketing cost (MC) that leads to future gross contribution (GC) or the current GC that leads to future MC. Additionally, the issue of heterogeneity relates to the customer profiles, and has been found to influence purchase quantity and timing significantly (Allenby et al. 1999). When different customers respond differently to marketing messages, the contribution margin model must reflect it by allowing the regression weights to be different for each customer. Simultaneously modeling purchase frequency, MC, and GC and accounting for customer heterogeneity solves both these issues, and provides more accurate results. Studies that have modeled these parameters simultaneously have for instance, used Bayesian decision theory (Venkatesan, Rajkumar, V. Kumar, and Timothy Bohling (2007)) and Conway–Maxwell– Poisson distribution (Boatwright et al. 2003). By simultaneously modeling the parameters, it is possible to obtain an early warning indication of abrupt changes in interpurchase times and purchase quantity for a customer. The following table provides the likelihood function for the joint purchase timing-quantity model, its merits, and shortcomings.

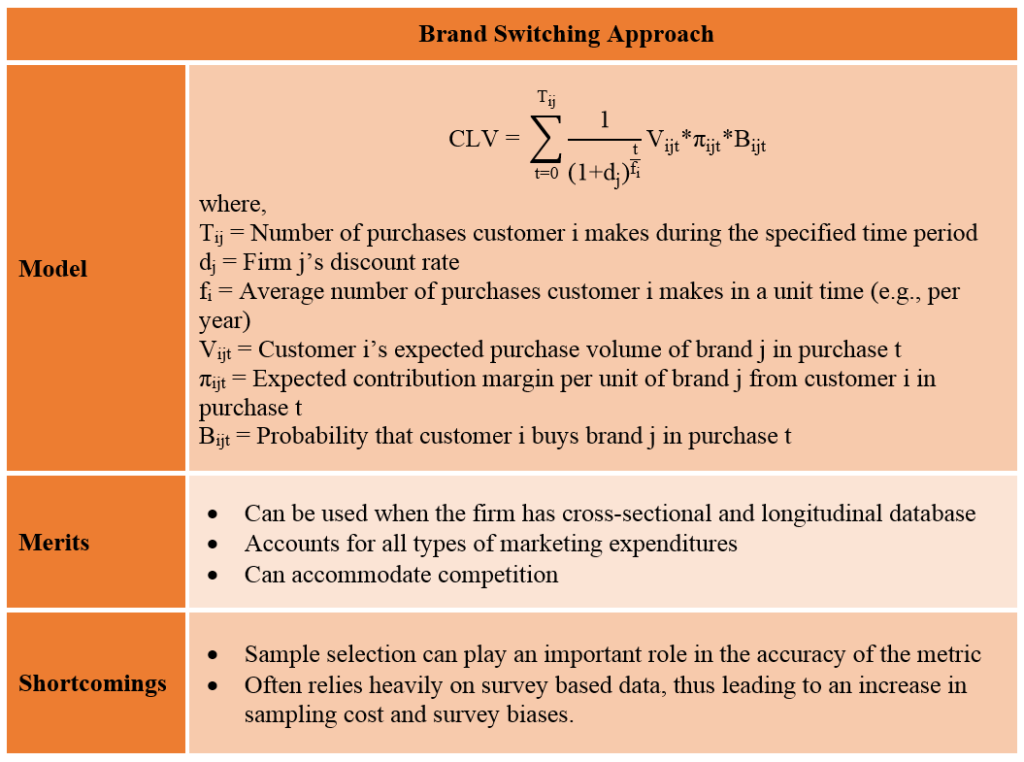

Brand-switching approach (Rust et al. (2004)): This approach requires collecting information on the brand purchased in the previous purchase occasion, the probability of purchasing different brands, and individual-specific customer equity driver ratings from the customers (Rust et al. 2004). Through a Markov switching matrix, the individual customers’ probability of switching from one brand to another based on individual-level utilities is modeled. The probability thus calculated is multiplied by the contribution per purchase to arrive at the customer’s expected contribution to each brand for each future purchase. The summation of expected contribution over a fixed time period after making adjustments for the time value of money produces the CLV for the customer.

Since this model does not require a voluminous longitudinal database, it can work in a wide range of settings. Further, the model considers any type of marketing expenditure, and does not limit itself to expenditures that are targeted one-to-one. By modeling competition and incorporating purchases from competitors, this model is a marked departure from traditional models that do not consider competition. The following table provides the approach to compute the lifetime value based on this approach.

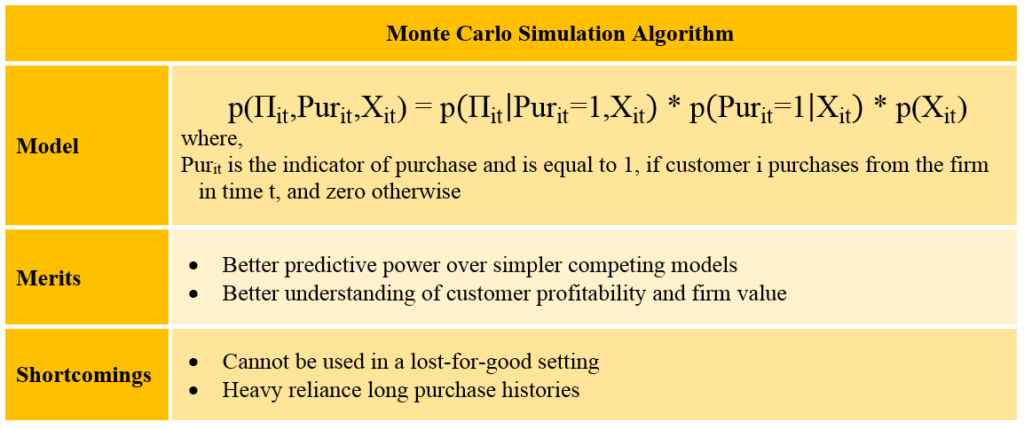

Monte Carlo simulation algorithm (Rust, Kumar, and Venkatesan (2011)): Whereas managerial heuristics and empirical models have uncovered important insights on customer value, studies have also investigated the use of simulation models. The reason for exploring simulation methods stems from relatively unsuccessful attempts at predicting future customer profitability, with very simple models often performing just as well as more sophisticated ones. For instance, Campbell and Frei (2004) find that it is easier to predict future profitability for some customers than for others, even for customers within the same profit tier. Similarly, Malthouse and Blattberg (2005) find that their best models misclassify most customers who are predicted to have high profitability, and Donkers, et al. (2007) show that the simplest model they test performs the best and provides better predictions than other models. These studies make the case for alternate approaches such as a simulation method.

Rust, Roland T, V .Kumar, and Rajkumar Venkatesan (2011) present a Monte Carlo simulation method that can accurately predict future customer profitability, and perform better than existing methods. They accomplish this in an “always-a-share” setting wherein, customers never completely terminate their relationship with a firm. Hence, in this approach, firms measure future profitability of a customer by predicting his/her purchase pattern over a prediction period, and do not predict when a customer will terminate the relationship with the firm. This simulation approach projects many possible futures, indicating many possible profitability trajectories (and total future profits) for each customer. These replications are averaged to obtain the expected future profitability for each customer for the time horizon desired. The results indicate that this approach produces large prediction improvements over the simpler competing models. The following table provides the joint probability of gross profit, customer purchase and marketing contacts, merits, and shortcomings.

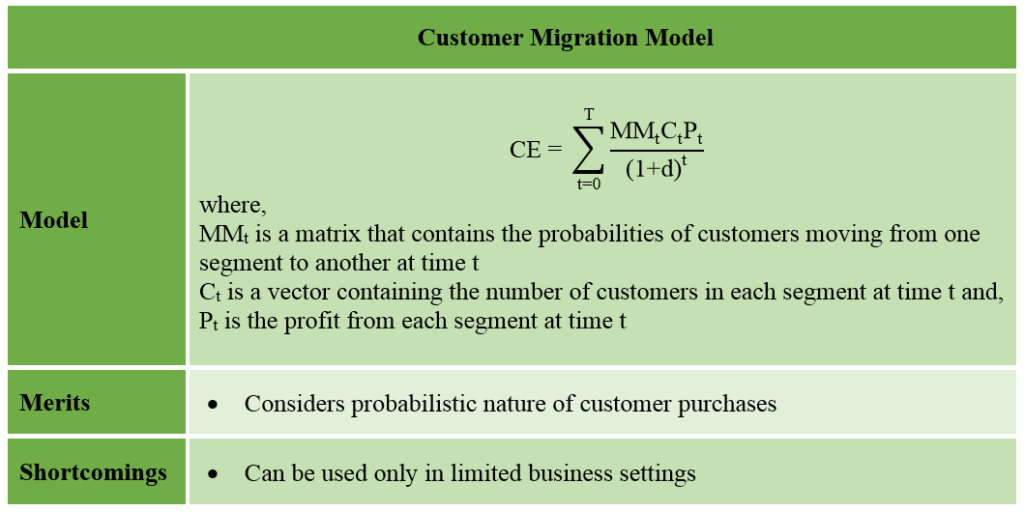

Customer migration model (Dwyer (1997)): Using this model, customer behavior can be predicted based on historical probabilities of purchase depending on recency and the current recency state in which the customer is located (Dwyer 1997). Further generalizations included segmentation variables such as the RFM metric and other demographic variables. This model proved to be a significant development over the basic model of CLV, in that it considers the probabilistic nature of customer purchases (Jain and Singh 2002). The purchase probabilities are updated based on past purchase behavior. Therefore, a customer might still be considered retained by a firm even if he/she does not purchase in any particular period(s). However, the model is constrained by its applicability to only certain business settings, and its assumptions such as (a) the dependence only on the previous period’s purchase to compute the propensity of purchase, and (b) the condition that the sale and cash flow occur together in each period. The following table provides the customer migration approach to measure customer equity, its merits, and shortcomings.

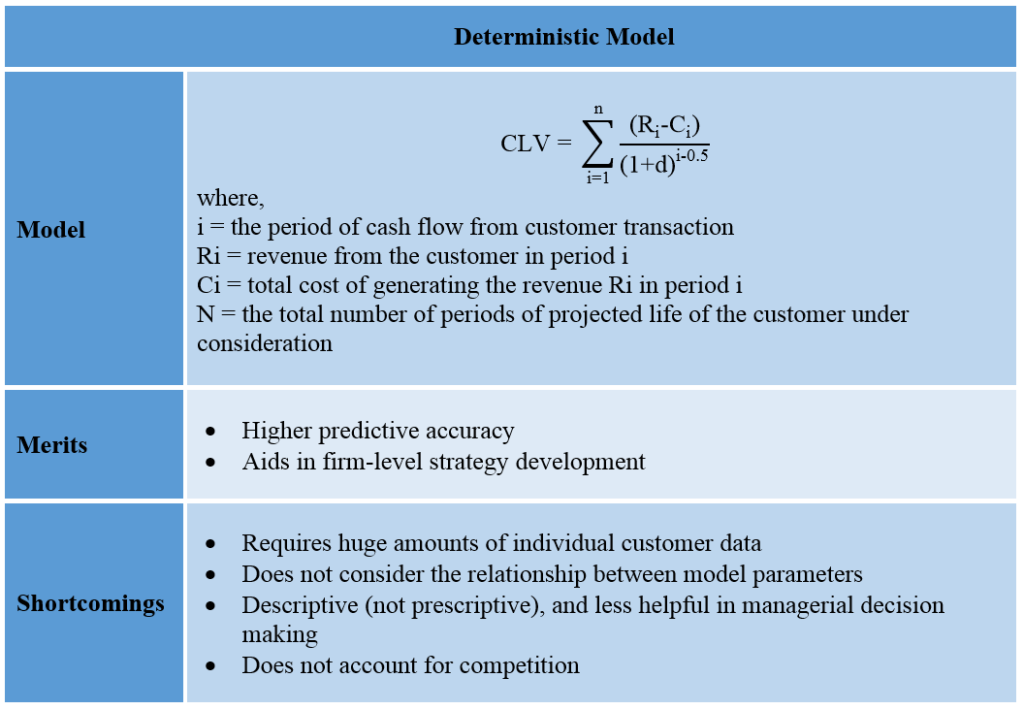

Deterministic model (Jain and Singh (2002)): Deterministic models precisely model the outcomes as determined by parameter values, relationship states, and initial conditions. These models focus on inputs and outputs, and leave little room for variations. Typically, these models are used to study firm actions such as customer acquisition, customer retention, customer profitability, cross-buying behavior, and product return behavior (Reinartz and Kumar 2003; Reinartz and Kumar 2000). While this model does not account for acquisition costs, other models assume a constant gross contribution margin and marketing costs (Berger and Nasr 1998). Several variations of this basic model have been proposed and used (Blattberg et al. 2001; Dwyer 1997; Keane and Wang 1995). Despite the ease of implementation, the typical shortcomings of this type of model include (a) the requirement of huge amounts of individual customer data, (b) not considering the relationship between model parameters, (c) being descriptive and therefore not helpful in managerial decision making, (d) not considering information on competition, and (e) the inability to model latent behavior (Villanueva and Hanssens 2007). However, with recent advancements in data availability and sophisticated modeling techniques, some (if not all) of the shortcomings could be removed, and we would begin to see a model that can calculate CE with better accuracy. The following table provides the basic form of the deterministic approach used to model CLV, its merits, and shortcomings.

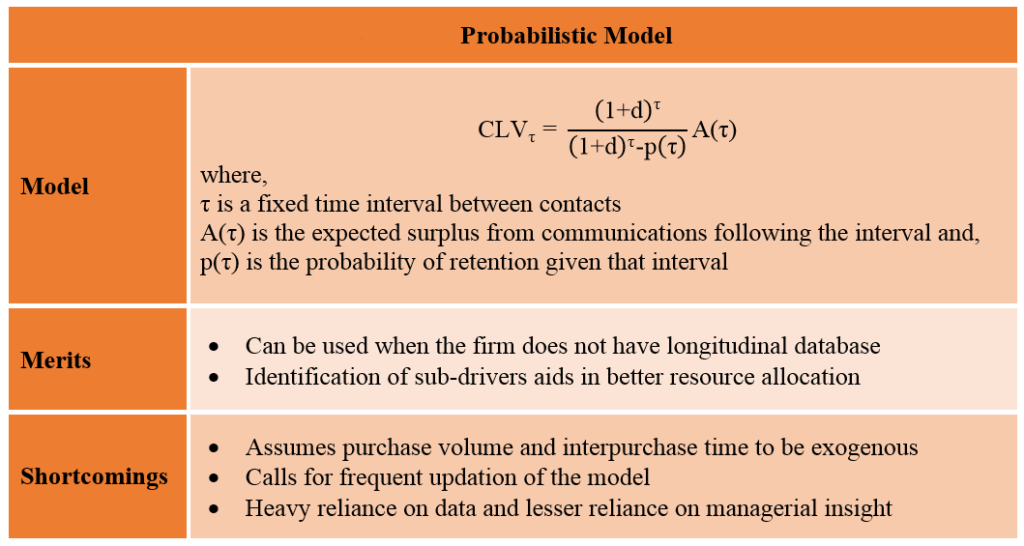

Probabilistic model (Drèze and Bonfrer 2009)): In a probabilistic model, the observed behavior is viewed as the realization of an underlying stochastic process governed by latent (unobserved) behavioral characteristics, which in turn, vary across individuals. The focus of this type of model is on describing (and predicting) the observed behavior instead of trying to explain differences in observed behavior as a function of covariates (as is the case with any regression model). In other words, this type of model assumes that the consumers’ behavior varies across the population according to some probability distribution (Gupta, Sunil, Dominique Hanssens, Bruce Hardie, Wiliam Kahn, V. Kumar, Nathaniel Lin, Nalini Ravishanker, and S Sriram (2006)). The following table provides the probabilistic approach used to model CLV, its merits, and shortcomings.

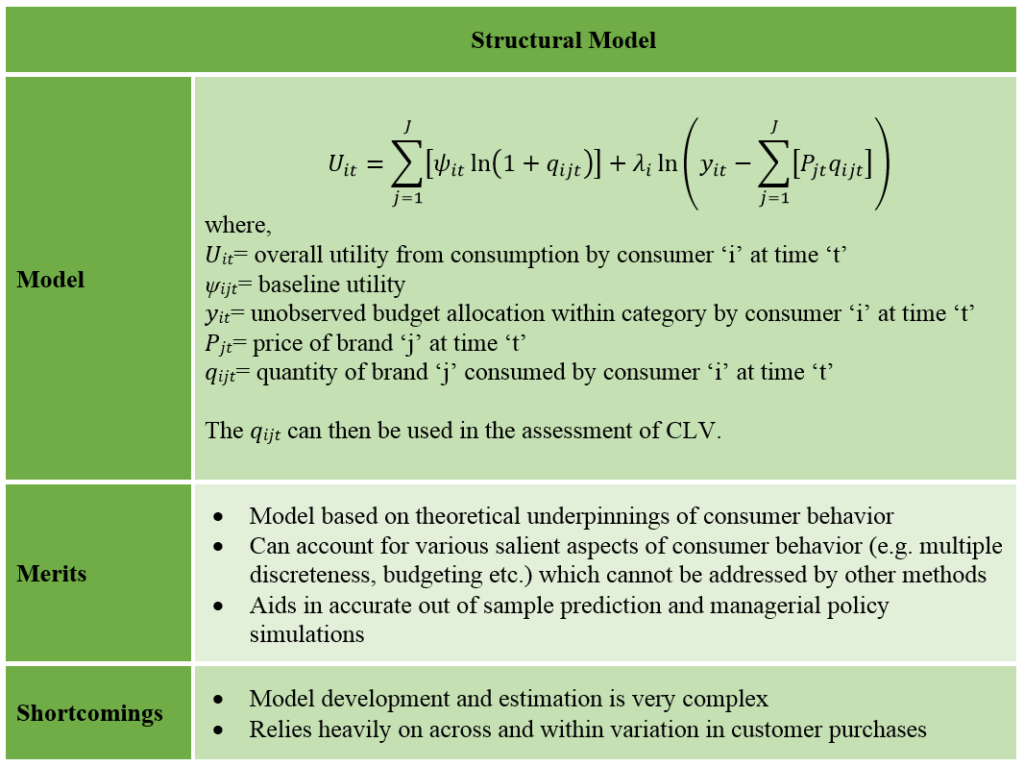

Structural model (Sunder, Kumar, and Zhao (2016)): In many instances, such as the consumer packaged goods industry, consumers may purchase more than one brand in one purchase occasion. In such circumstances, the CLV computation is affected by the problem of multiple discreteness. While prior studies have investigated this issue (Kim et al. 2002; Manchanda et al. 1999), the results have been suboptimal since conclusions regarding the quantity decision could not be made effectively. Sunder, Sarang, V. Kumar, and Yi Zhao (2016) adopts a direct utility approach to structurally model multiple discreteness while accounting for variety seeking behavior in the demand model in assessing CLV of consumers in the consumer packaged goods (CPG) setting. Further, the study is conducted on a longitudinal transaction database, and allows the budget to vary deterministically with time. Additionally, this is the first study to unify choice, timing, and quantity decisions in a single equation thereby providing a direct approach to assess CLV. The following table provides the approach to model the utility function, its merits, and shortcomings.

Whereas the models discussed here are the most popular ones, there will always be continual improvements to the CLV model because of the nature of the availability of customer data and the business situation. Further, knowing how to implement the models is also helpful in determining how CLV can be managed at different firms.

References

Keane, Timothy J., and Paul Wang (1995), “Applications for the lifetime value model in modern newspaper publishing,” Journal of Direct Marketing, 9 (2), 59-66.

Dwyer, Robert F. (1997), “Customer lifetime valuation to support marketing decision making,” Journal of Interactive Marketing, 11 (4), 6-13.

Berger, Paul D, and Nada I Nasr (1998), “Customer Lifetime Value: Marketing Models and Applications,” Journal of Interactive Marketing, 12 (1), 17-30.

Allenby, Greg M, Robert P Leone, and Lichung Jen (1999), “A dynamic model of purchase timing with application to direct marketing,” Journal of the American Statistical Association, 94 (446), 365-74.

Manchanda, Puneet, Asim Ansari, and Sunil Gupta (1999), “The “shopping basket”: A model for multicategory purchase incidence decisions,” Marketing Science, 18 (2), 95-114.

Reinartz, Werner J., and V. Kumar (2000), “On the Profitability of Long-Life Customers in a Noncontractual Setting: An Empirical Investigation and Implications for Marketing,” Journal of Marketing, 64 (4), 17-35.

Blattberg, Robert C, Gary Getz, and Jacquelyn S Thomas (2001), Customer equity: Building and managing relationships as valuable assets: Harvard Business Press.

Niraj, Rakesh, Mahendra Gupta, and Chakravarthi Narasimhan (2001), “Customer profitability in a supply chain,” Journal of Marketing, 65 (3), 1-16.

Jain, Dipak, and Siddhartha S Singh (2002), “Customer lifetime value research in marketing: A review and future directions,” Journal of interactive marketing, 16 (2), 34-46.

Kim, Jaehwan, Greg M Allenby, and Peter E Rossi (2002), “Modeling consumer demand for variety,” Marketing Science, 21 (3), 229-50.

Boatwright, Peter, Sharad Borle, and Joseph B Kadane (2003), “A model of the joint distribution of purchase quantity and timing,” Journal of the American Statistical Association, 98 (463), 564-72.

Reinartz, Werner J., and V. Kumar (2003), “The Impact of Customer Relationship Characteristics on Profitable Lifetime Duration,” Journal of Marketing, 67 (1), 77-99.

Campbell, Dennis, and Frances Frei (2004), “The persistence of customer profitability: Empirical evidence and implications from a financial services firm,” Journal of Service Research, 7 (2), 107-23.

Rust, Roland T., Katherine N. Lemon, and Valarie A. Zeithaml (2004), “Return on Marketing: Using Customer Equity to Focus Marketing Strategy,” Journal of Marketing, 68 (1), 109-27.

Venkatesan, Rajkumar and V. Kumar (2004), “A Customer Lifetime Value Framework for Customer Selection and Resource Allocation Strategy,” Journal of Marketing, 68 (4), 106.

Malthouse, Edward C, and Robert C Blattberg (2005), “Can we predict customer lifetime value?,” Journal of Interactive Marketing, 19 (1), 2-16.

Gupta, Sunil, Dominique Hanssens, Bruce Hardie, Wiliam Kahn, V. Kumar, Nathaniel Lin, Nalini Ravishanker, and S Sriram (2006), “Modeling customer lifetime value,” Journal of Service Research, 9 (2), 139-55.

Donkers, Bas, Peter C Verhoef, and Martijn G de Jong (2007), “Modeling CLV: A test of competing models in the insurance industry,” Quantitative Marketing and Economics, 5 (2), 163-90.

Venkatesan, Rajkumar, V. Kumar, and Timothy Bohling (2007), “Optimal customer relationship management using Bayesian decision theory: An application for customer selection,” Journal of Marketing Research, 44 (4), 579-94.

Villanueva, J., and D. M. Hanssens (2007), “Customer Equity: Measurement, Management and Research Opportunities,” Foundations and Trends in Marketing, 1 (1), 1 – 95.

Rust, Roland T, V .Kumar, and Rajkumar Venkatesan (2011), “Will the frog change into a prince? Predicting future customer profitability,” International Journal of Research in Marketing, 28 (4), 281-94.

Kumar, V., and Werner Reinartz (2016), “Creating Enduring Customer Value,” Journal of Marketing, Vol. 80 (Nov.), 36-68.

Sunder, Sarang, V. Kumar, and Yi Zhao (2016), “Measuring the Lifetime Value of a Customer in the Consumer Packaged Goods (CPG) industry,” Journal of Marketing Research, 53 (6), 901-21.