CUSTOMER VALUATION THEORY & FIRM VALUE

Augmented Customer Value through the Wheel of

Fortune Strategies

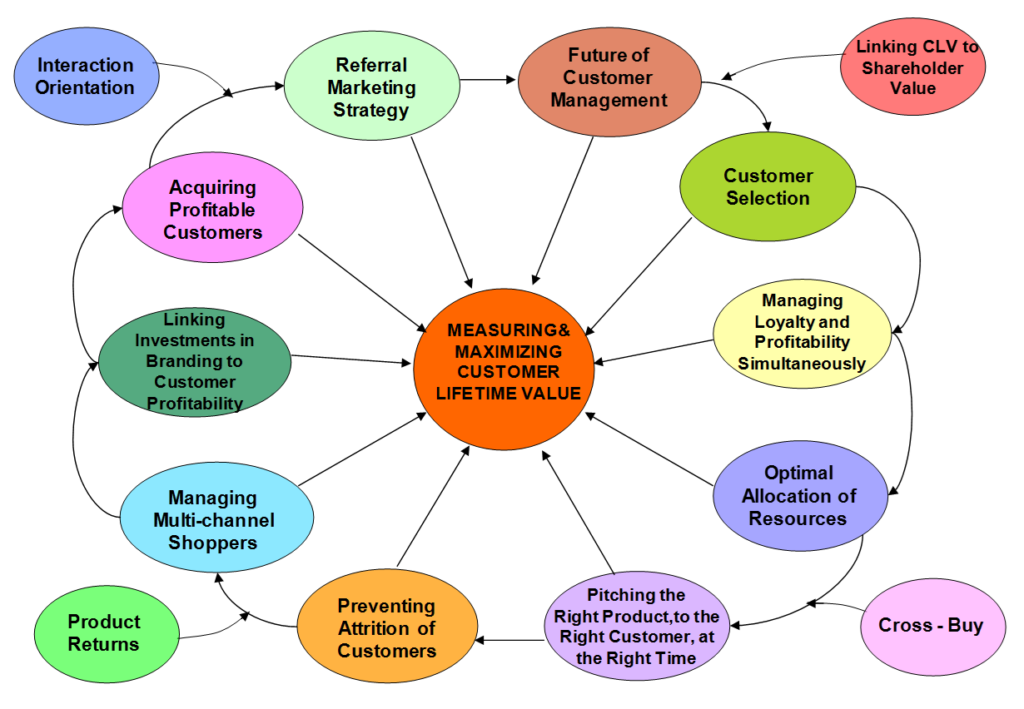

Once a firm has used CLV to determine directly contributed customer value, it can then use that information to implement value-maximizing strategies. This added impact of customer value corresponds to the depth of the contribution. Using CLV, firms can effectively select for profitable customers, manage loyalty and profitability among the customer base simultaneously, and optimize the allocation of resources, among other managerially value-generating actions. In this regard, the Wheel of Fortune Strategies have been developed to aid firms in addressing marketing issues with greater confidence (Kumar (2008), (2013)). This set of strategies answers the following questions:

How do firms identify the ‘right’ customers to manage? Reinartz and Kumar (2000) found that long-life customers are not necessarily profitable customers, and call for the use of forward-looking metric like CLV to identify the “right” customers to manage.

How can firms ensure profitable customer loyalty among their customers? When customized managerial actions were implemented at a B2C catalog retailer based on segmenting customers on loyalty and profitability, Reinartz and Kumar (2002) found that loyal customers know their value to the company and demand premium service, believe they deserve lower prices and, spread positive word-of-mouth only if they feel and act loyal.

How to increase customers purchases across multiple product categories to improve customer profitability? By encouraging customers to buy across more product categories through profitable customer management strategies, Kumar, et a (2008) found metrics such as revenue per order, margin per order, revenue per month, margin per month, and orders per month increased as customers shopped across multiple product categories. However, not all cross-buying is good. Shah, Denish, V. Kumar, Yingge Qu, and Sylia Chen (2012) found that across 5 B2B and business-to-customer (B2C) firms, 10%–35% of the firms’ customers who cross-buy are unprofitable and account for a significant proportion (39%–88%) of the firms’ total loss from its customers. Therefore, discerning profitable cross-buying from unprofitable cross-buying behavior is essential.

How do firms decide which prospect will make a better customer in the future, and is therefore worthwhile to acquire now? Using test and control groups, Reinartz, Werner, Jacquelyn S. Thomas, and V. Kumar (2005)showed that acquiring and retaining the ‘right’ customers garnered a B2C firm an incremental profit of $345,800 with an ROI close to 860%.

How do firms decide the timing of an offering to a customer? When done right, results have showed that firms increased their profits by an average of $1,600 per customer, representing an increase in ROI of 160% (Kumar et al. 2006).

How should firms monitor customer activity, in order to readjust the form and intensity of their marketing initiatives? In managing firm actions regarding customer acquisition and retention efforts,Reinartz, Werner, Jacquelyn S. Thomas, and V. Kumar has found that it is not sufficient to consider how much to spend on acquisition or retention alone, but instead on how firms must balance acquisition and retention spending together to maximize profitability and doubling the ROI.

Should firms invest in building brands, customers, or both brands and customers? Kumar, et al. (2018) has shown that by understanding the link between investments in branding and CLV, firms can efficiently allocate their resources to generate maximum value. We have observed that a 5% increase in the investments in branding causes the CLV to go up by over 25%.

Should firms realign themselves to implement CLV and its related strategies, and if so, how? (Ramani and Kumar2008).

How can firms enhance their value through the customers’ referral behavior? By implementing customized campaigns for each customer value segment, B2B and B2C firms have realized large profit gains, representing a higher ROI (Kumaret al. 2013; Kumaret al. 2010; Kumaret al. 2007).

How do firms leverage the CLV metric to drive their stock price and provide more value to their stakeholders? By linking CLV-based actions to a firm’s stock price, B2B and B2C firms have reported significant increases of about 35% and 57% in their stock prices, better prediction of stock price movements, and superior performance with respect to the stock market index and rival firms (Krasnikov, Alexander, Satish Jayachandran, and V. Kumar (2009); Kumarand Shah 2009).

References

Krasnikov, Alexander, Satish Jayachandran, and V. Kumar (2009), “The impact of customer relationship management implementation on cost and profit efficiencies: evidence from the US commercial banking industry,” Journal of Marketing, 73 (6), 61-76.

Kumar, V. (2008), Managing Customers for Profit: Strategies to Increase Profits and Build Loyalty. Upper Saddle River, NJ: Wharton School Publishing.

Kumar, V. (2013), Profitable Customer Engagement: Concept, Metrics, and Strategies. New Delhi, India: Sage Publications.

Kumar, V., Morris George, and Joseph Pancras (2008), “Cross-buying in retailing: Drivers and consequences,” Journal of Retailing, 84 (1), 15-27.

Kumar, V., M. Luo, and V. R. Rao (2018), “Linking an individual’s brand value to the CLV: An integrated approach,” Working Paper, Georgia State University, Atlanta, GA.

Kumar, V., J Andrew Petersen, and Robert P Leone (2013), “Defining, measuring, and managing business reference value,” Journal of Marketing, 77 (1), 68-86.

Kumar, V., J Andrew Petersen, and Robert P Leone (2010), “Driving profitability by encouraging customer referrals: who, when, and how,” Journal of Marketing, 74 (5), 1-17.

Kumar, V., J Andrew Petersen, and Robert P Leone (2007), “How valuable is word of mouth?,” Harvard Business Review, 85 (10), 139-46.

Kumar, V., and Denish Shah (2009), “Expanding the Role of Marketing: From Customer Equity to Market Capitalization,” Journal of Marketing, 73 (6), 119.

Kumar, V., and Rajkumar Venkatesan (2005), “Who are the Multichannel Shoppers and How do they Perform? : Correlates of Multichannel Shopping Behavior,” Journal of Interactive Marketing, 19 (2), 44-62.

Kumar, V., Rajkumar Venkatesan, and Werner Reinartz (2006), “Knowing What to Sell, When, and to Whom,” Harvard Business Review, 84 (3), 131-7, 50.

Petersen, J Andrew, and V. Kumar (2009), “Are product returns a necessary evil? Antecedents and consequences,” Journal of Marketing, 73 (3), 35-51.

Petersen, J Andrew, and V. Kumar (2015), “Perceived Risk, Product Returns, and Optimal Resource Allocation: Evidence from a Field Experiment,” Journal of Marketing Research, 52 (2), 268-85.

Ramani, Girish, and V. Kumar (2008), “Interaction orientation and firm performance,” Journal of Marketing, 72 (1), 27-45.

Reinartz, Werner J., and V. Kumar (2002), “The Mismanagement of Customer Loyalty,” Harvard Business Review, 80 (7), 86-94.

Reinartz, Werner J., and V. Kumar (2000), “On the Profitability of Long-Life Customers in a Noncontractual Setting: An Empirical Investigation and Implications for Marketing,” Journal of Marketing, 64 (4), 17-35.

Reinartz, Werner, Jacquelyn S Thomas, and V. Kumar (2005), “Balancing acquisition and retention resources to maximize customer profitability,” Journal of Marketing, 69 (1), 63-79.

Shah, Denish, V. Kumar, Yingge Qu, and Sylia Chen (2012), “Unprofitable cross-buying: evidence from consumer and business markets,” Journal of Marketing, 76 (3), 78-95.

Venkatesan, R., and V. Kumar (2004), “A Customer Lifetime Value Framework for Customer Selection and Resource Allocation Strategy,” Journal of Marketing, 68 (4), 106.